World Bank delays Sh96.9 billion loan to Kenya over anti-corruption law standoff

The government now plans to borrow Sh591.9 billion from the local credit market to bridge a Sh876.1 billion budget deficit in the financial year starting July, raising concerns over the impact on private sector credit and job creation.

The World Bank has postponed the release of a Sh96.9 billion loan to Kenya after the country failed to pass a key anti-corruption law, leaving the Treasury facing a major funding gap just weeks before the financial year ends.

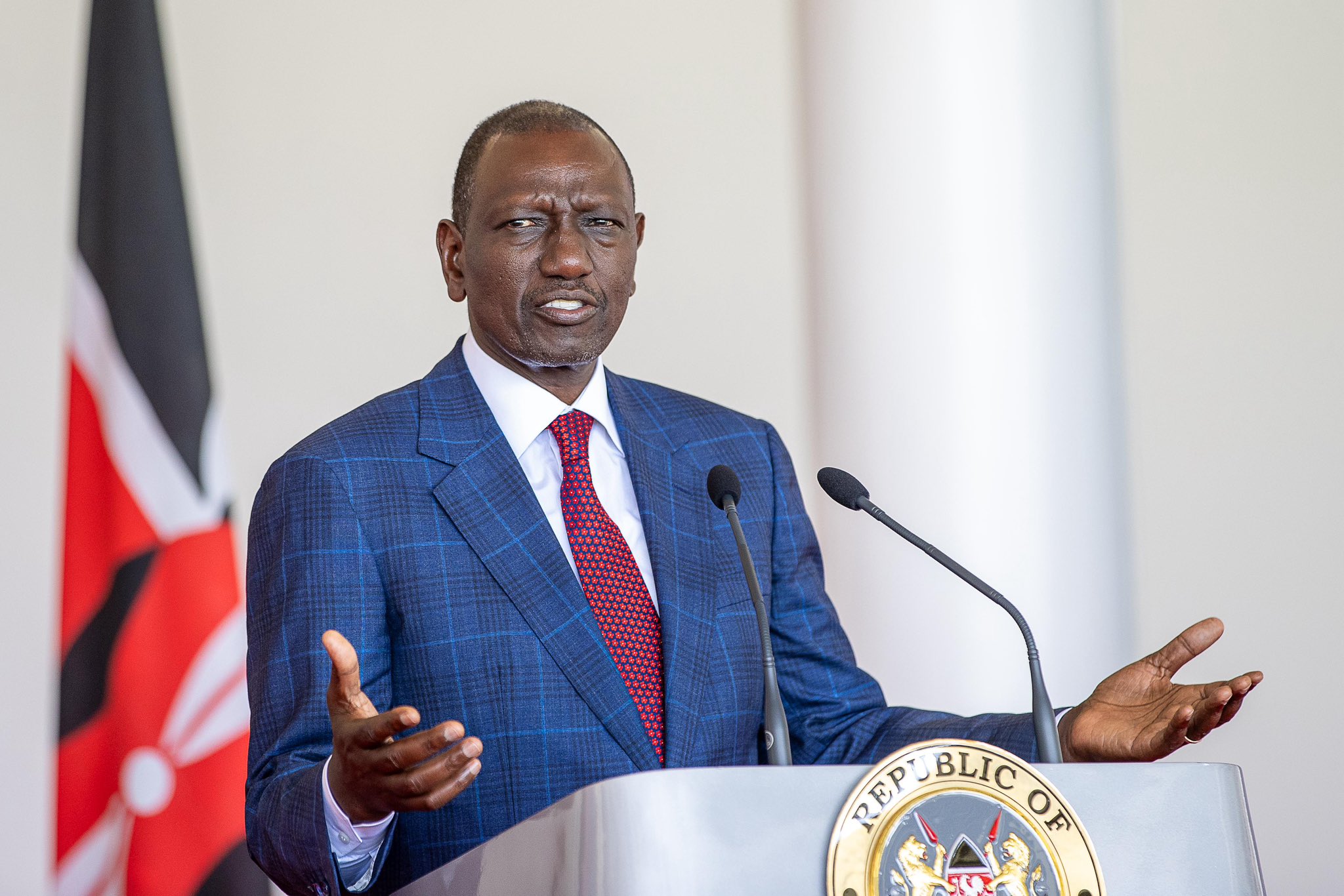

Treasury Cabinet Secretary John Mbadi said the earliest the funds could be released is in July, with the government now grappling with a Sh97 billion hole in the 2024/25 budget. The delay comes after President William Ruto declined to sign the Conflict of Interest Bill, 2023, into law, citing concerns over 12 clauses that had been weakened by MPs.

More To Read

- World Bank flags wasteful spending on public servants’ travel allowances

- Why Kenya risks losing billions if it ignores World Bank public sector reform recommendations

- Saudi Arabia, Qatar to settle Syria's outstanding arrears of around $15 million to World Bank

- Treasury report: China tops list of Kenya’s debt payments to external creditors

- World Bank warns Kenya on unsolicited PPP deals after Adani Group contract cancellations

- World Bank wins $100 billion replenishment of fund for poorest countries

“The WB funding seems to be going to July because some of the legislations (Conflict of Interest Bill) that were precedent to the release of these funds were delayed,” Mbadi said. “The Conflict of Interest Bill was a key Bill for the WB to give us the funding, and when it was unlocked, there was no time to take it to the WB board for approval. We are going to June 30 with a Sh97 billion hole that, as the CS, I did not prepare for.”

The World Bank had made passage of the Bill a condition for the release of the funds. Among the provisions the President objected to were definitions of what constitutes a conflict of interest for public servants, a clause that permitted officials to accept gifts while on duty, and another that required state offices to maintain a record of all gifts received.

With mounting debt repayments—especially to China—and sluggish tax revenue, Kenya has increasingly turned to external lenders like the World Bank and the African Development Bank for budget support. This shift came after the International Monetary Fund (IMF) discontinued its own budget support.

The delay in funding has forced the Treasury to prepare a third supplementary budget for the current financial year. Treasury documents show that some departments have already overspent their allocations, intensifying the pressure.

For instance, the State Department of Social Protection and Senior Citizens exceeded its Sh35.7 billion budget by Sh2.4 billion by April, while State House had spent 98 per cent of its Sh7.96 billion allocation in the same period.

According to budget plans, Kenya will continue to rely on the World Bank for support until at least the 2028/29 financial year, expecting to receive a total of Sh682 billion in equal annual disbursements. The first tranche of Sh170.5 billion is expected in the financial year starting July 1, 2025.

The government now plans to borrow Sh591.9 billion from the local credit market to bridge a Sh876.1 billion budget deficit in the financial year starting July, raising concerns over the impact on private sector credit and job creation.

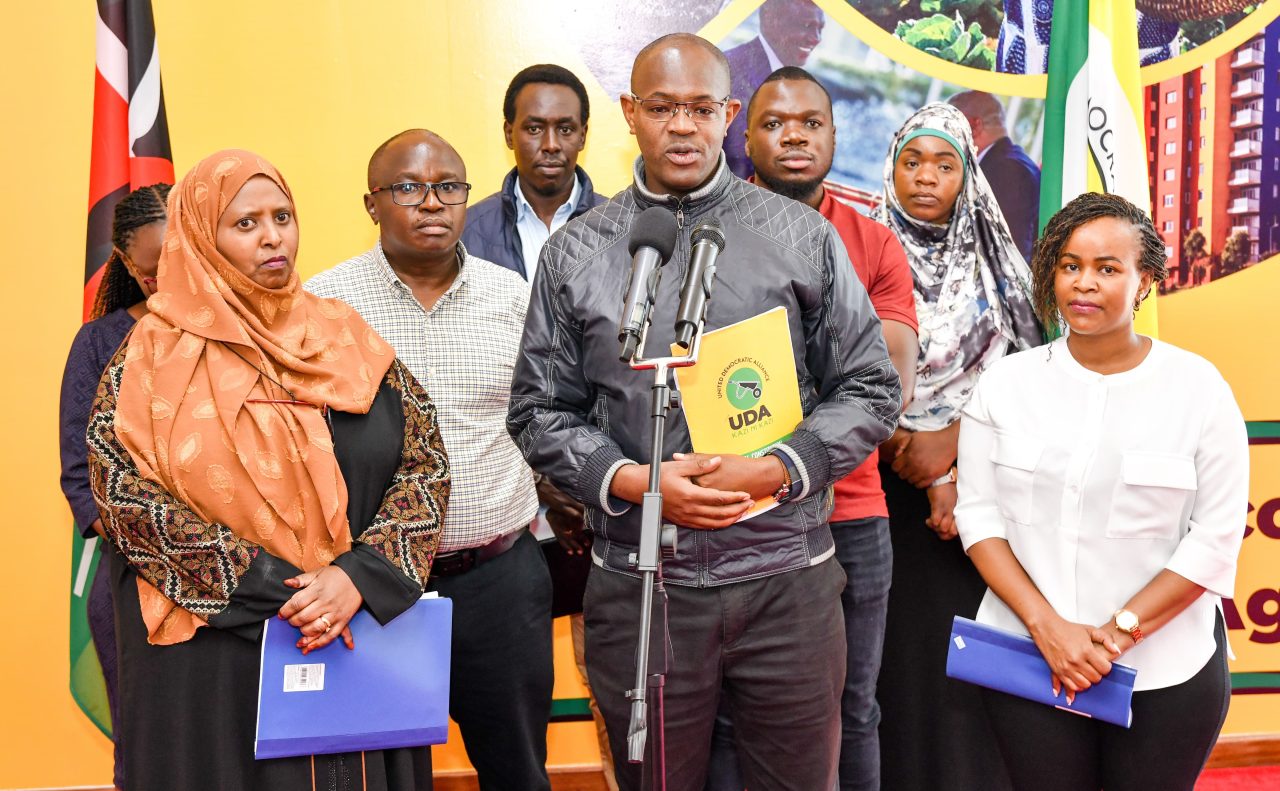

A report by the Budget and Appropriations Committee (BAC) tabled in the National Assembly on Wednesday shows that only Sh284.2 billion of the deficit will be sourced externally, with the bulk expected to come from local lenders.

The committee, chaired by Samuel Atandi, has warned that such heavy domestic borrowing could either limit access to credit for private businesses or push up interest rates, making borrowing more expensive.

“Despite the declining interest in government securities locally due to easing monetary policy stance, continued reliance on domestic borrowing might either crowd out the private sector or result in high borrowing costs,” the committee noted.

The warning comes as credit to the private sector continues to decline, despite a drop in commercial bank lending rates from 17.2 per cent in November 2024 to 15.8 per cent in March 2025. Credit growth contracted by 1.3 per cent in February and only recovered marginally by 0.2 per cent in March.

According to the Central Bank of Kenya, bank lending to the private sector shrank by 1.4 per cent in December 2024 compared to the previous year. The decline was partly linked to the stronger shilling, which affected the valuation of foreign currency-denominated loans.

With most jobs being generated by private businesses, the ripple effect has already hit employment numbers. The 2025 Economic Survey shows new job creation dipped slightly to 703,700 from 720,900 in 2023, with the private sector contributing 90 per cent.

The BAC report underscores the need for fiscal responsibility, urging the government to maintain the deficit within projections and avoid upward revisions during supplementary budgets.

Concerns about the state’s borrowing strategy are shared by the Central Bank, the Institute of Social Accountability, and the Institute of Public Finance, all of which have cautioned against the government competing with businesses for local credit.

Meanwhile, the Kenya National Chamber of Commerce and Industry (KNCCI) is projecting a challenging financial year for businesses due to high taxes, the cost of living, and unfriendly policies.

Findings from the 2025 KNCCI Business Barometer, which surveyed 1,981 businesses of all sizes and sectors, show that 60 per cent of firms do not plan to increase their workforce this year.

“The negative outlook on employment growth is linked to a decline in sales and an increase in operational costs,” the report read.

Top Stories Today